Étude de cas - Processus sans papier

Profil Credit et le Bureau de l’Industrie alimentaire fournissent des rapports de crédit et des outils d’analyse des risques à l’ensemble des entreprises de l’industrie alimentaire canadienne.

- Client

- The food industry credit bureau

- Année

- Service

- Automatisation des processus et du système

Aperçu

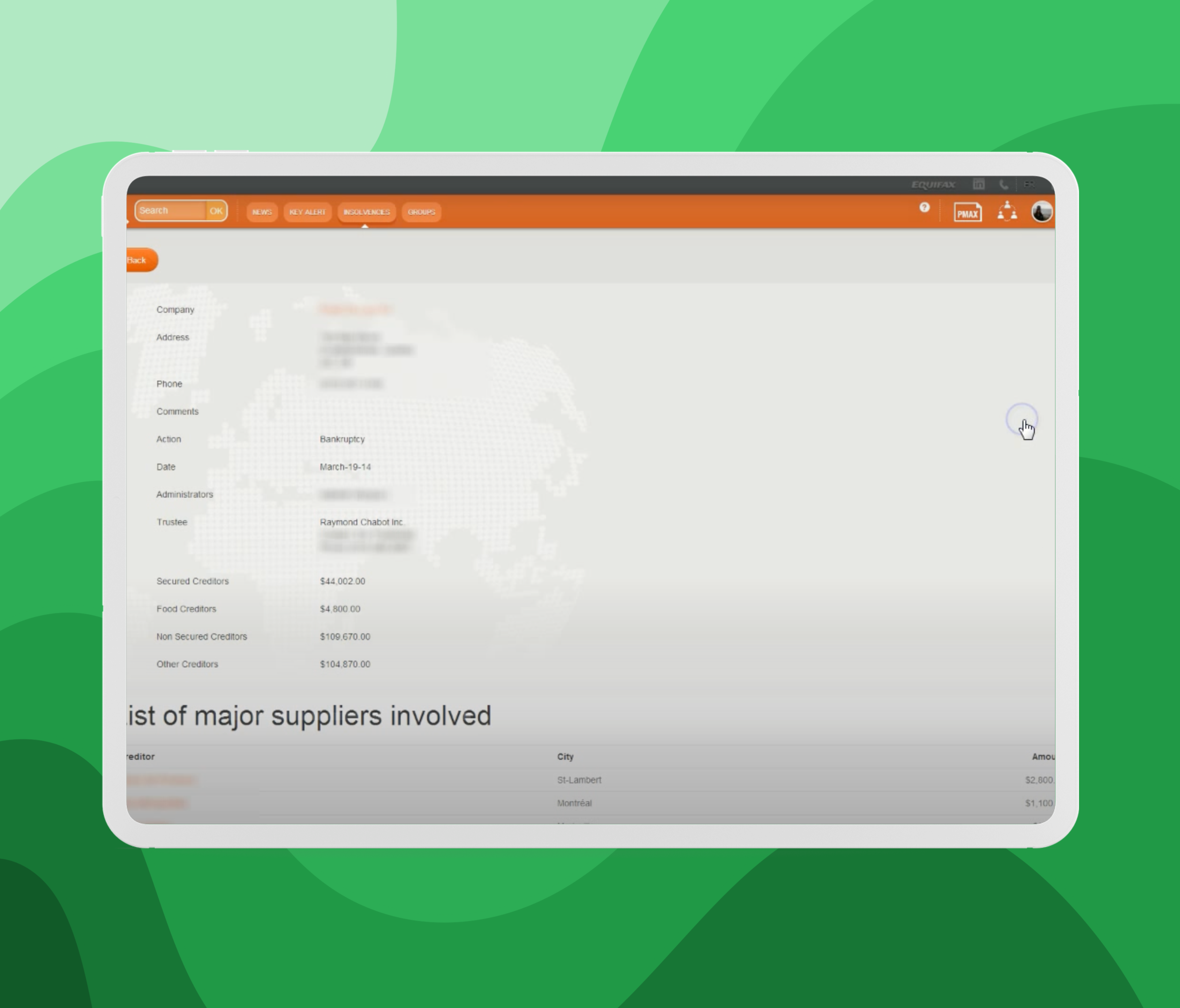

Notre relation commerciale remonte à janvier 2001 avec Profil Credit. Depuis 2004, il existait un projet interne appelé “Travail à domicile 2004”, mais il n’a jamais abouti. L’entreprise est un bureau de crédit avec de nombreux processus manuels impliquant des formulaires papier nécessitant des signatures qui sont transmis de va-et-vient avec les banques.

En mars 2020, lorsque la pandémie a frappé, les employés ont dû travailler depuis chez eux ; par conséquent, tous les processus manuels devaient être convertis en processus sans papier et entièrement automatisés via des opérations en arrière-plan et des applications web.

Nous avons commencé par remplacer toutes les opérations manuelles de télécopie. L’entreprise utilisait déjà Slack comme plateforme de communication principale, nous l’avons donc utilisé avec les problèmes de télécopie envoyés directement au propriétaire du document. Cela a permis de réduire le délai de réception des données de crédit des banques et d’autres sources afin que les clients reçoivent leurs rapports de crédit plus rapidement.

Un autre changement important a été l’ajout d’un répartiteur automatique de documents, éliminant le besoin d’un humain pour répartir les documents. Nous avons ajouté la gestion des documents au système de back-office existant que nous avons construit en 2010, permettant aux employés distants d’avoir un contrôle complet sur les documents sans être sur site.

Notre participation

- Document management (Go)

- OCR / dispatching

- Infrastructure

J’ai eu le plaisir de travailler avec Dominic pendant de nombreuses années en tant que chef de projet chez Profil Crédit. Je peux affirmer en toute sécurité que sans Dominic, Profil Crédit n’aurait pas eu le succès qu’il a connu. Son leadership, sa curiosité, son esprit innovant et évidemment ses compétences extraordinaires nous ont aidés à réaliser plusieurs grands projets. Du CRM personnalisé à la Plateforme Client Web Interactive, Dominic a créé les outils les plus innovants de l’industrie.

nbsp;

Notre projet le plus récent, et probablement l’une de ses plus grandes réalisations chez Profil Crédit, a été la construction d’un système sans papier pour l’équipe d’investigation. Cela a non seulement permis à Profile Credit de réduire les coûts, mais a également augmenté la productivité. De plus, ce système était la clé pour commencer à travailler à distance dès le début de la pandémie.

Directrice générale adjointe

- Fax entrants/sortants par mois

- 30k

- D'assignation automatique des documents

- 70%

- Par employé d'économie

- 1.5h